Buy vs rent: the eternal question

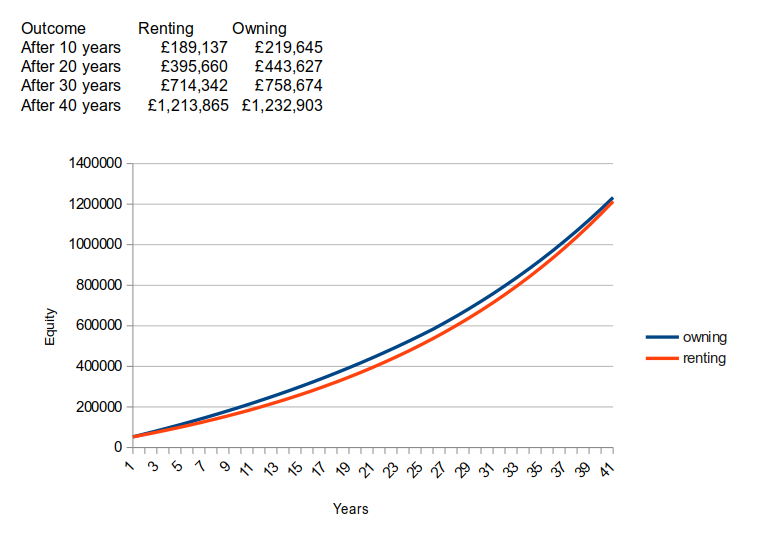

Should you own your accommodation, or should you rent? Most people have the intuitive notion that owning your accommodation is better financially. I wanted to explore this idea, so I created a spreadsheet comparing buying vs renting over a long period of time. I wanted to take into account all aspects of renting vs all aspects of owning in order to provide a true picture of what could be your financial position in a number of years ahead. I computed 40 years, assuming you leave your parent’s home at 25 and retire at 65.

Here are some notes about the spreadsheet to help you understand it:

- I used the rental value and property value of a mid-range accommodation in the area I live.

- The spreadsheet does not show inflation, but indirectly takes it into account as all the rates are given with inflation removed; for example, if you expect a diversified portfolio to return 7% per year and the inflation rate is 2%, the real rate of return is 5% and this is what I entered into the spreadsheet.

- Buying means that you need to put down a deposit; so to have a fair comparison, I assumed that the “rent” option would take that money and invest it into a diversified portfolio.

- Whatever difference there is between monthly rent and monthly mortgage payment is invested in a diversified portfolio.

- I assumed you would remortgage every 5 years.

- I assumed you would move accommodation every 10 years for a property of similar value.

The conclusion, at least with the numbers I punched in, is that renting or owning result in approximately the same amount of wealth after 40 years. This actually depends a lot on the rental yield. If the rental yield is high, owning is much better. If it is low, renting puts you in a better position.

Overall, I still do believe that owning your accommodation is preferable, if only for the fact that you have more control over the property. When you rent, the landlord will usually put so many restrictions you can’t even hang a picture on the wall. Also, people sometimes downsize in their later years, and the release equity will typically provide a better return because it can be invested in a diversified portfolio compared to the usual increase in accommodation value. The other advantage of owning is that you have no choice but to pay the mortgage. If you rent, you have to have enough discipline to invest the surplus instead of spending it or falling for lifestyle inflation, which is much harder to do and will require a lot of willpower from you.

On the other hand, renting is more flexible and allows to you move to another place or country easily.

Here is the spreadsheet if you want to give it a try.