What should I do with my money? A comprehensive guide to money in life

In the family I grew up, there was absolutely no talk about money. Money was evil. Money was taboo. As a consequence, I started my adult life without any idea of how I should handle money. When I started working, I was quite happy with the idea that I would spend all my salary and that as long as my account wasn’t in red at the end of the month, everything was fine.

I am very happy I matured a lot from those times, and I educated myself in many ways on how to handle money. After 20 years, I can say that these are the following rules in a nutshell:

- Don’t ever go into debt, except possibly to get a mortgage (or a student loan in very limited cases)

- Keep your expenses low

- Save as much as possible; half - yes half - of your monthly salary is a reasonable target

The one figure you should track like a hawk is your expenses. There are many apps and websites that allow you to track and categorise your expenses nowadays. I use Yolt, which is free and reasonably good at its job, but you are free to use whatever fits your fancy. The important is that you must know accurately where you are spending money.

From there, your job is to lower your expenses and keep them low. I have seen tons of motivational videos, personal finance blogs and self-help books pushing forward the idea of the “latte effect”, and how much you actually miss by buying a Starbucks latte once a day. Heck, I have even seen videos on YouTube about how you can use less toilet paper and thus buy less of it! To me, these are insane advice that will help you save very little with a guaranteed result: a life of privation and misery. If you follow a weight-loss diet based on restricting portion sizes, you will get hungry and miserable very quickly, and in all likelihood you will stop following it at some point. In the same way, saving pennies on the little pleasures of life will make you miserable and much less likely to keep to it in the long term.

To this I say “no”. Sort your expense categories from highest to lowest and start from the top. For most people, the largest expense category will be housing (rent, mortgage, etc.) So that’s where you need to start. Find ways to lower that expense. Do you need that extra room? Do you need to live in that expensive neighbourhood? What about living in a Motorhome? By moving further way from London, I saved £325 on rent every month and got a bigger property. Now, that’s good savings! (BTW, I am not inconsistent, I did need that extra room :-p) Then you move to the next expense category and so on. The goal is not to deprive yourself of all the little things that make life more pleasurable, but you just need to find cheaper ways to fulfil your desires. To come back to the latte example, if you really do spend too much on lattes? You might want to buy a latte-making machine and that will save you some money in the long run.

The most important is to get out of the consumer mindset. A consumer has a core (and often unconscious belief) that happiness can be bought. “I need a big house to have more space”. “I need a sports car to impress other people”. “I need my Starbucks mocha latte every morning to wake me up”. Maybe you need to go out in nature more, start chess or basketball to boost your self-esteem or have a better sleep hygiene.

There is a growing trend nowadays to recycle and reuse. Someone’s rubbish is another’s treasure, as they say. You can find pre-owned, perfectly good items on Trash Nothing (or equivalent for your country), Facebook Market and dozens of other websites and apps. You can use those instead of buying new.

The second figure you need to follow closely is your net worth. You should (and I actually do it) maintain your own balance sheet and income statement. For your balance sheet, write down all your assets first (properties, investments, savings, pensions, etc.), then all your liabilities (credit cards, mortgages, loans, etc.) By the way, if you own the property you live in, add it to the assets. There is considerable debate as to whether your family house is an asset. I consider it is because you can sell it, realise its equity and live in a rental accommodation. Conversely, if your house is in negative equity, try convincing anyone that your house is not a liability! Anyway, subtract your liabilities from your assets and you have your net worth. An incredible amount of people have a negative net worth, which is an absolute emergency that should be addressed immediately. Your goal over time is to grow your net worth, because that’s what you’re going to retire on. The higher your net worth, the sooner you can retire, and the more enjoyable your retirement will be. There a whole movement of people trying to retire early, sometimes in their thirties. A quick search on internet will give you many results (eg: Mr Money Mustache and Early Retirement Extreme).

Regarding liabilities, I think you should never go into debt except for the following exceptions:

- A mortgage (provided you buy a small and inexpensive property)

- A credit card or two, provided the balance is repaid in full every month (having a credit card will help your credit score when you want a mortgage)

- [Very tentatively] A student loan where advanced studies are strictly necessary for the job you want to do (i.e. doctor, civil engineer and other regulated professions that require a degree)

A student loan should be repaid as quickly as possible. Some argue that a mortgage is not that big a deal and can be repaid slowly because the rate of interest will usually be very low and money can be invested instead of being used for additional mortgage payments. I understand this argument, however:

- The interest rates won’t necessarily stay low; not too long ago, interest rates in the UK were 15% and more; there is always the possibility that an economic shock will push up interest rates high in the future.

- Your investments might go down in value and you might then think that bringing your mortgage down would have been a better use for that money.

Any other form of debt is totally unacceptable, including (but not limited to):

- Car loan

- Using debt to buy a smartphone, TV, clothes, holidays, etc.

- Borrowing money from friends and family

- A 24 months plan to pay your new smartphone as part of a mobile data plan (instead, buy the phone directly, ideally second hand)

You should save as much as possible from your salary. The self-help industry has this mantra: “pay yourself first”. I think it makes a lot of sense. Carve a fixed chunk of your salary every month and invest it. This method forces you to save and adapt. Whatever you saved should be left alone to grow over time. Don’t “dip” into your savings to buy that fancy new iPhone 31. These savings should be ring-fenced in your mind for your retirement only.

That’s also why experts advise to keep a small fund for rainy days that will allow you to cover your expenses for 3, 6 or 12 months in case of emergency. I think first of all you should ensure you have adequate insurance cover for various calamities that can happen to you (illness, accident, and any other problem that can hamper your ability to work). I think a rainy days fund that covers 3 months of expenses is enough if you have some credit cards with unused balance and some good insurance policies. Provided you have a real emergency (i.e. something that prevent your income from coming, like an accident putting you off work - and a 20% off deal of that brand new iPhone is not an emergency), I would consider accruing some balance on those credit cards acceptable, because that’s unlikely you will run into any such emergency in your lifetime. Also, building up 12 months worth of expenses will takes years for some people and they might get discouraged in the meantime.

Now the billion dollar question is: What should I do with the money I carve out of my salary? The answer is obviously to invest it, but the real question is: How? I do know a little bit about investing. I actually tried different things, such as picking stocks, buy-to-let, joint ventures… I even tried (unsuccessfully) to start my own business! I also passed the CFA level one just to understand better the investment world. After 10 years of various experiments, I can have a deep and honest look at my less than stellar results, and humbly conclude that it’s very hard to get above-average returns. At the end of the day, even the vast majority of professional investors will be beaten by the market over a long period of time, so what chance do I have?

Now I recognise my lack of knowledge and expertise, and I decided to fully embraced my averageness. I believe this has been the smartest decision in my investing endeavours. I recommend the method suggested by Lars Kroijer in his excellent book: Investing Demystified. Essentially, he suggests that you invest in a worldwide index fund and safe government bonds. The mix between the two will depend on your risk tolerance and time horizon. And that’s essentially what I am doing now. I’m average and feel at peace about it because all the research and science tells me that I took the right decision in terms of risk vs rewards for my investments. Final words of advice: choose a broker with low expenses and use tax shelters whenever possible.

There is a huge self-help industry predicated on the idea that you can be successful by starting your own business, investing in penny stocks, etc. I will redirect you to this excellent blog post on Monevator for the business idea. The truth is that we can’t all be the next Steve Jobs, Elon Musk or Warren Buffett. This is totally obvious that we can’t all be above average, and yet the self-help industry wants you to believe that all you need is (1) the conviction that you can do it and (2) to buy their kit that will reveal the mysterious secrets for success. The truth is: being average in a country with an advanced economy is success in itself. The self-help industry is just after your money, because you will always fall short of the promised success and just need that one more seminar, that final book or that ultimate course.

If you really want to start a business, I believe what you absolutely need is: (1) to fail fast (determine whether that business idea of yours will work or not before engaging a significant amount of effort and money), (2) to understand that you will be married with your business 24/7 for the next 10 years, (3) to accept that your lifespan and healthspan will be reduced by 5 to 10 years, and (4) a mentor. Of all these, having a true mentor is the most important in my opinion. Please be aware that the vast majority of people starting a business will remain working like crazy in that same business until the business ends or is sold.

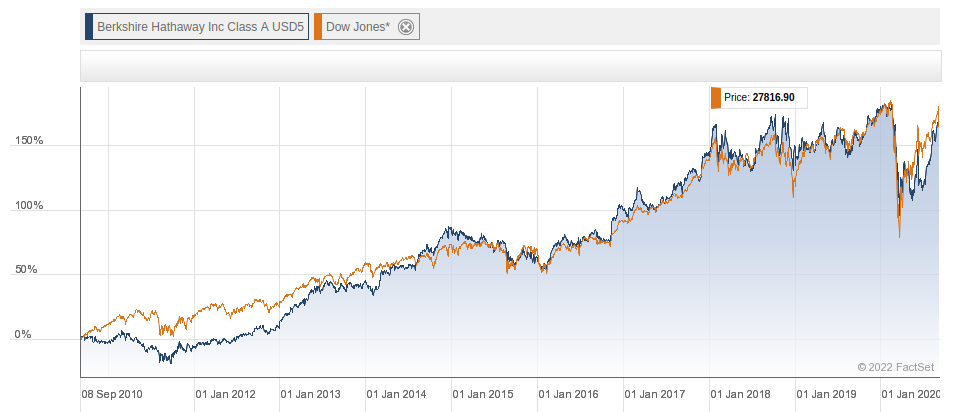

In terms of stock-picking, here is a sobering sight:

The performance of Berkshire Hathaway has been similar to the Dow Jones over the past 10 years. So you can see that even Warren Buffett is ending up average after all.

For my part, I am totally done with chasing returns and fortune. I am happy to be average, get average returns for minimal risks, sleep better at night and to have more time for myself and my family.

To know how much you need to save for retirement and how it will take, I will redirect you to this post from Mr Money Mustache.

And that’s pretty much everything you need to know. Please feel free to dig deeper into each subject if you want to, their is a wealth of resources on the internet or in books.